Research Interests

Monetary Economics

Economics of Development

Industrial Organization

Labor Economics

Time Series Analysis

Supply Chain Management

I have worked as a Research Assistant at the University of Chicago Booth School of Business and am presently a Research Assistant at St. Xavier's College, Mumbai.

Economics of Development

Industrial Organization

Labor Economics

Time Series Analysis

Supply Chain Management

I have worked as a Research Assistant at the University of Chicago Booth School of Business and am presently a Research Assistant at St. Xavier's College, Mumbai.

Projects

- Imperfect Credit Markets in Unequal Societies

July 2012 - Present

I'm currently working with Dr. Menezes at St. Xavier's College, where we are analyzing imperfect credit markets specifically with respect to education. We wish to determine whether finance for education is forthcoming only if collateral is available and whether down payment is a deterrent to beginning the process of applying for education loans. We also wish to analyze whether private financiers are reluctant to enter markets with significant imperfect information. As a corollary, we want to determine whether an informal credit system can exist in poor communities.

My responsibilities include background literature research, assembly and construction of data sources through the implementation of questionnaires, hypothesis testing and regression analysis.

- Risk Taking Incentives of Money Market Funds

May 2012 - Present

I worked with Yeguang Chi and Antionio Picca over the summer of 2012 at UChicago Booth. I assisted in their study of the the relationship between risk-taking of money market funds and potential determinants such as sponsor's reputation, equity and credit default swap (CDS) price. We plan to extend existing research to account for the European debt crisis, study the correlation between sponsor's equity and fund-sponsoring choice and replicate previous results with certain modifications. I continue to provide research assistance till the completion of the project.

- Analysis of Chinese Mutual Fund Performance Constructing a Fama French 3 Factor Model

May 2012 - Present

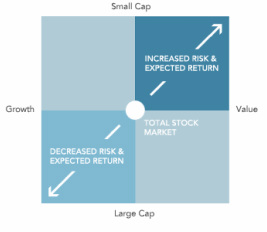

This project involves extending the Fama French 3 Factor model to the Chinese mutual fund industry. My initial task was to compute the SMB and HML factors for the mutual fund data as well as the annualized monthly return.

- The Holt-Winters Exponential Smoothing Model & Parameter Optimization

Advisor: Dr. B.E. Narkhede, Head-Production Engineering Department, VJTI, Mumbai

July 2012 - January 2013

The aim of this paper is to analyze seasonal time series data using the Holt-Winters exponential smoothing model, thus developing an adaptive demand forecast. I utilized six years’ monthly consumption data and created a one-year-ahead forecast with quarterly intervals. Initial level and trend parameters of the forecast model are estimated by running a linear regression on the deseasonalized demand data. The initial seasonal parameters are estimated as the ratio of observed demand to the deseasonalized demand. Normalization of the seasonal parameters thus obtained, reduces the forecast error. The smoothing constants and are optimized by minimizing the Mean Squared Error (MSE), resulting in the best possible fit to the data. Performance measures such as Mean Absolute Deviation (MAD) and Tracking Signal (TS) are established in order to determine the accuracy of the Holt-Winters forecast Performance measures are established in order to determine the accuracy of the Holt-Winters model. I also perform an examination of the Dennis (1978) run based adaptive procedure and argue that an adaptive exponential smoothing model does not necessarily produce more accurate forecasts compared to a constant exponential smoothing model (where the smoothing constants have been optimized).